#11 Why Should Every Company Hold Bitcoin on Its Balance Sheet?

x20 in the next 10 years

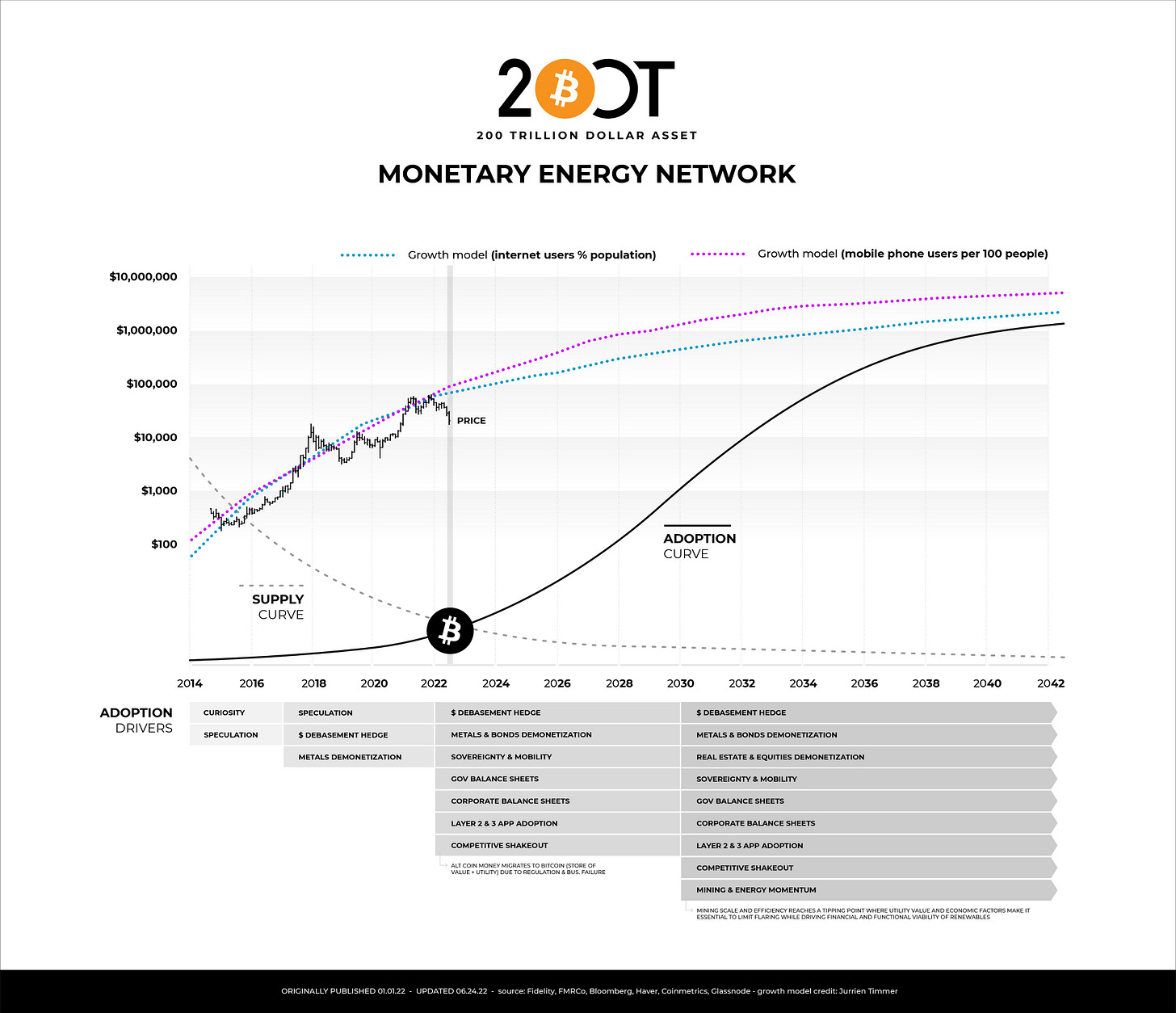

Over the next twenty years, the narrative of Bitcoin as a speculative asset will cease to make sense. Anyone who still sees it merely as a static, linear bet dependent on market cycles and emotional swings simply hasn’t grasped the nature of what we’re building. Bitcoin is a growing monetary network, with exponential network effects, a live adoption curve, and a programmed scarcity that continuously pushes a reevaluation of its price relative to the fiat system.

But beyond the technological and financial layers, there’s a deeper point that is beginning to resonate in boardrooms, family holdings, patrimonial structures, and even local governments: any society that wishes to preserve value and maintain future optionality should have Bitcoin on its balance sheet.

The reason is simple: we are witnessing the birth of a base layer of value that is gradually but inevitably replacing the traditional reserve system. And this is not a theory. It is observable.

If you look at the chart accompanying this text, you will see three fundamental curves: internet adoption, mobile phone users, and Bitcoin’s projected adoption curve over the decades. Today, we are entering the phase of serious institutional adoption. The years of curiosity and speculation are behind us. What comes now is a phase where private and public treasuries that do not hold Bitcoin on their balance sheets will be, quite literally, at a structural disadvantage.

There are several reasons why this is already evident:

We’ve passed the Lindy effect point of no return: the longer Bitcoin survives, the more legitimacy it gains

The regulated infrastructure is ready: ETFs, institutional custody, BTC-backed loan platforms, corporate ERP integrations

The narrative framework is shifting: it’s no longer just about “disruptive technology” but about an “antifragile asset for multigenerational structures”

For a company, a family, a small city, or an association, having Bitcoin on the balance sheet today is a modern version of owning land, gold, or a water source in ancient times. It’s not a financial play. It’s an architectural decision.

At Sobtree, we want to help societies and individuals understand what we are building from scratch. Anyone looking for more personalized guidance should not hesitate to reach out to us by email.

This requires:

Having an SL or holding company with a corporate purpose that allows for treasury and investment management

Integrating Bitcoin as part of the corporate assets from the start or through non-monetary capital contributions

Establishing internal rules for custody, usage strategy, and limits on liquidity/BTC-backed debt

Setting up loan platforms with BTC as collateral to obtain liquidity in euros or dollars without selling the asset, with safe rates and clear structures

There are more and more regulated platforms in Europe that allow companies to operate with BTC as collateral, with contracts adapted to SL or GmbH structures and proper tax integration. I won’t name them here directly because they’re part of the internal system we share with serious clients, but if you write to me, I’ll send them your way.

This is where the qualitative leap happens: when your company can operate in the real world, invoice, invest, and live… without ever selling the asset that gives it structural solidity. It’s like a city operating with a gold bar buried underground, using it as collateral without ever having to melt it.

And the beauty of it is that every adoption cycle pushes a reevaluation of that collateral. If today you place €100,000 in BTC on your SL’s balance sheet and leave it for 10 years, the conservative scenario based on this adoption curve projects multiples of 10x to 20x, with recyclable collateral for successive operations. Literally, a liquidity-generating base throughout the company’s life.

That’s why I say it’s not about whether a society should hold Bitcoin. It’s about how soon it will integrate it, and under what conditions. Because those who arrive first won’t just have a financial edge. They’ll have a structural advantage in resilience, sovereignty, and the ability to act without permission.

The societies that understand this today will be the ones building the bridges to the new financial world. The others will simply pay toll.